pa auto sales tax

Begin Main Content Area. If you trade in a vehicle only the difference between the value of the trade-in vehicle and the purchase price of the new vehicle is taxed.

Pennsylvania Sales Tax Small Business Guide Truic

If the vehicle will be registered in Allegheny County PAs 2 nd most populous county theres an added 1 local sales tax for a total of 7 sales tax on a vehicle purchase.

. Therefore your total monthly lease payment would be 500. For instance if your new car costs you 25000 you can expect to pay an additional 1500 in state sales tax alone. 6 tax rate and more In Pennsylvania a vehicle is subject to sales tax since its considered personal property.

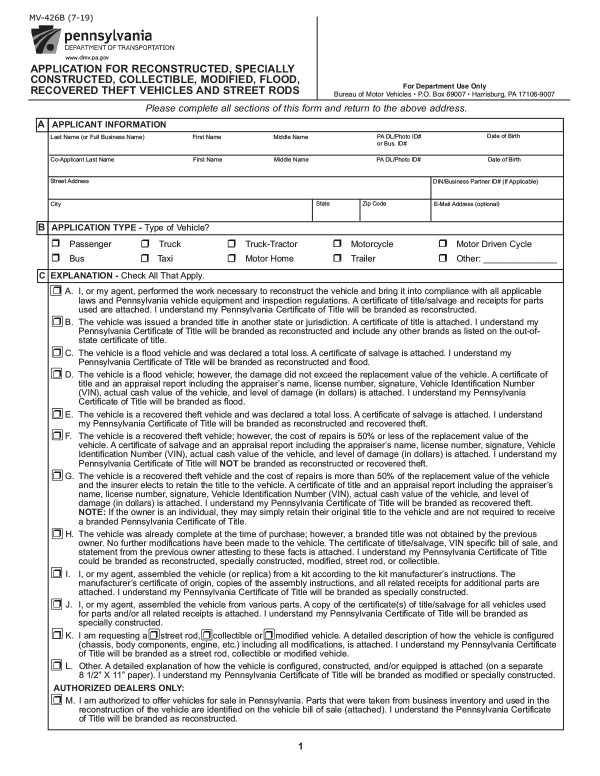

Calculate By ZIP Codeor manually enter sales tax. Less than 2 hours. This form must be completed by all transferees and transferors and attached to Form MV-1 or MV-4ST for any transfer for which a gift exemption Exemption 13 for purposes of Pennsylvania Sales and Use.

Some dealerships may also charge a 113 dollar document preparation charge. In the state of Pennsylvania sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Pennsylvania sales tax is 6 of the purchase price or current market value of the vehicle 7 for Allegheny County and 8 for the City of Philadelphia.

PA has a 6 sales tax rate for motor vehicles. Many taxpayers are unaware that sales tax due to the Department of Revenue is a percentage of the fair market value of a vehicle rather than a. STATE OR LOCAL SALES AND USE TAX STATE OR LOCAL HOTEL OCCUPANCY TAX PUBLIC TRANSPORTATION ASSISTANCE TAXES AND FEES PTA PASSENGER CAR RENTAL TAX.

Pennsylvania sales tax is 6 of the purchase price or the current market value of the vehicle 7 for residents of Allegheny County and 8 for City of Philadelphia residents. According to the Pennsylvania Department of Revenue the state sales tax rate for motor vehicles is 6 percent which is the same rate for other items that are subject to. Both the six percent PA sales tax and local tax one percent Allegheny County or two percent in Philadelphia County if applicable on vehicles is calculated on the cost of the vehicle minus the value of any trade-in.

If a warranty is part of the deal the value of the warranty is subject to tax. The white copy is always submitted to PennDOT. BUREAU OF DESK REVIEW AND ANALYSIS.

PA DEPARTMENT OF REVENUE. 500 X 06 30 which is what you must pay in sales tax each month. Shop All Locations 364 Philadelphia 220 Warrington 144 Vehicles 364 Shop All Vehicles 364 Philadelphia PA 220 Warrington PA 144 Cars Sedans 116 SUVs 198 Trucks 4 Minivans 19.

35 Easton Rd Warrington PA 18976 11600 Roosevelt Blvd Philadelphia PA 19116. Depending on local municipalities the total tax rate can be as high as 8. Motor vehicle sales tax is paid directly to the Department of Transportation which acts as a collection agent for the.

PA Aggressive Sales Tax Approach on Private Used Car Sales Motor Vehicle Understated Value Program MVUVP It has come to our attention that individuals who are purchasing a vehicle in PA via a private sale may receive a notice in the mail that they are being assessed PA sales tax in an amount greater than six per cent 6 of the purchase price. The VRT is separate from and in addition to any applicable state or local Sales Tax or the 2 daily PTA fee. Pennsylvania Certificate of Title.

Sales tax for a leased vehicle is calculated based on the states tax percentage and the cost of the lease payments. These taxes must be paid on the vehicle before registration is completed. Exact tax amount may vary for different items.

Typically when you buy a car in a different state than your home state the car dealer collects your sales tax at the time of purchase and sends it to your home states relevant agency. 2022 Pennsylvania state sales tax. Effective October 30 2017 a prorated partial day fee for carsharing services was provided as a clarification to the current vehicle rental fee.

Pennsylvania sales tax is 6 of the purchase price or current market value of the vehicle 7 for Allegheny County and 8 for the City of Philadelphia. The car sales tax in Pennsylvania is 6 of the purchase price or the current market value of the vehicle according to the PennDOT facts sheet. If you trade in a vehicle only the difference.

Payment can be made online when completing a PA-1 Use Tax Return. DMV Vehicle Services Vehicle Information Selling a Vehicle in PA. Imagine that your monthly lease payment is 500 and your states sales tax on a leased car is 6.

The car dealer will follow the sales tax collection laws of their own state. The sales tax rate for Allegheny County is 7 and the sales tax rate in the City of Philadelphia is 8. Pennsylvania State Sales Tax.

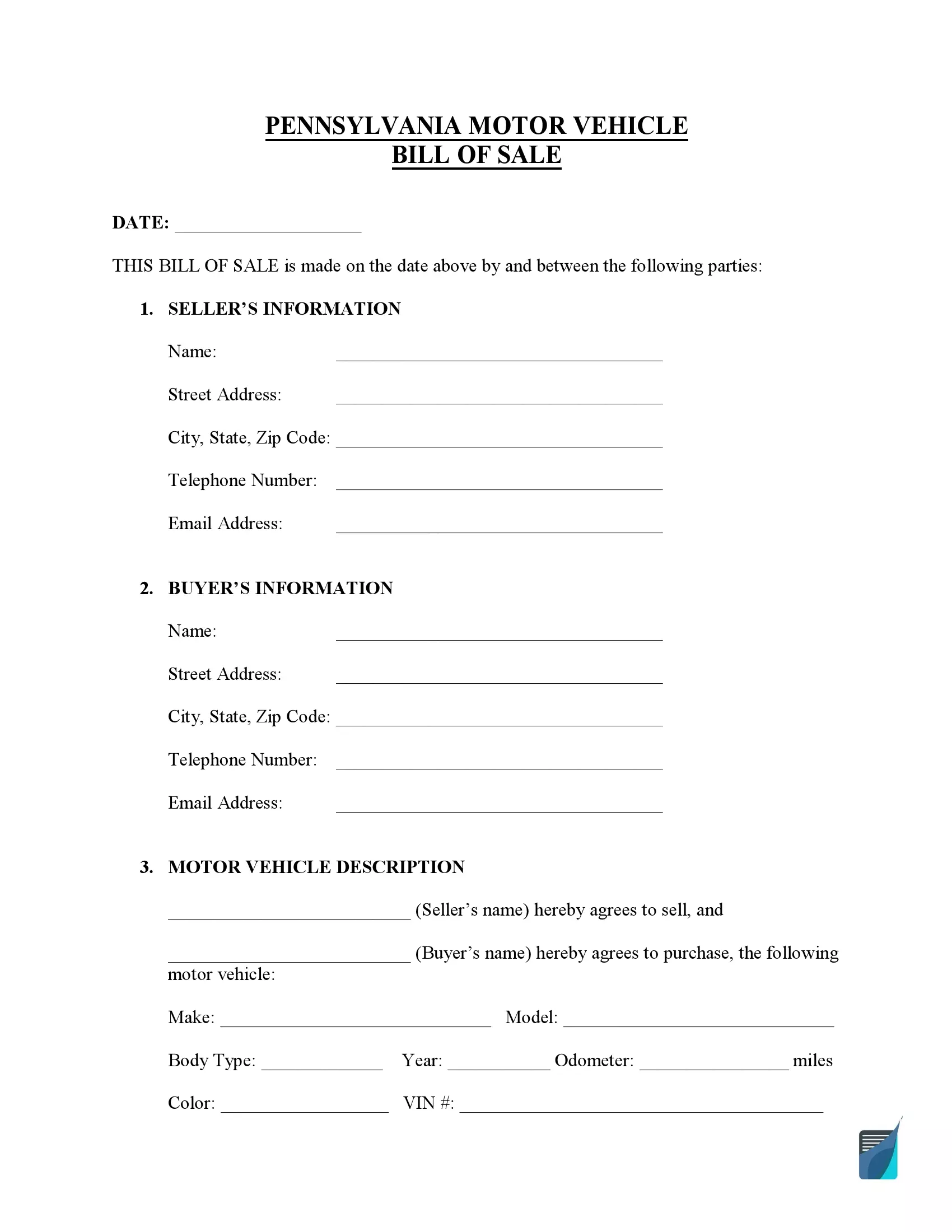

If the vehicle is being given as a gift the Form MV-13ST PDF Affidavit of Gift must be attached to the title application. Instructions for Completing Form MV-4ST Vehicle Sales and Use Tax ReturnApplication for Registration FOR PENNDOT AUTHORIZED AGENTS USE ONLY This form is used to obtain a Pennsylvania Certificate of Title for vehicles currently titled in Pennsylvania. 2 to 3 hours.

DISTRIBUTION OF FORM COPIES 1. In Philadelphia theres an extra 2 sales. 280901 HARRISBURG PA 17128-0901 Read Instructions On Reverse Carefully PENNSYLVANIA EXEMPTION CERTIFICATE CHECK ONE.

How Much Is the Car Sales Tax in Pennsylvania. The motor vehicle sales tax rate is 6 percent the same as on other items subject to sales tax plus an additional 1 percent local sales tax for vehicles registered in Allegheny County and a 2 percent local sales tax for vehicles registered in Philadelphia. BUREAU OF BUSINESS TRUST FUND TAXES DEPT.

Maximum Local Sales Tax. That way you dont have to deal with the fuss of trying to follow each states. The vehicle weight may affect the registration fee charged by PA Department.

Calculate By Tax Rateor calculate by zip code. The Pennsylvania PA state sales tax rate is currently 6. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Pennsylvania sales tax.

Harrisburg PA 17106-8597 unless the seller is planning to transfer the plate to another vehicle. The Pennsylvania state sales tax rate is 6 and the average PA sales tax after local surtaxes is 634. The fee schedule is as follows.

Some examples of items that exempt from Pennsylvania sales tax are food not ready to eat food most types of clothing textbooks gum candy heating fuels intended for residential property or. VIN verification is required for out of state vehicles. Pennsylvania collects a 6 state sales tax rate on the purchase of all vehicles with the exception of Allegheny County and the City of Philadelphia.

What Is Pennsylvania Pa Sales Tax On Cars

What Are The Vehicle Registration Taxes Fees In Pennsylvania Tri County Toyota

What S The Car Sales Tax In Each State Find The Best Car Price

Bills Of Sale In Pennsylvania All About Pa Forms And Facts You Need

Nj Car Sales Tax Everything You Need To Know

Free Pennsylvania Bill Of Sale Form Pdf Word Legaltemplates

What Is The Pennsylvania Sales Tax On A Vehicle Purchase Etags Vehicle Registration Title Services Driven By Technology

Free Pennsylvania Vehicle Bill Of Sale Form Pdf Formspal

Ilan S Auto Sales Glenside Pa Cars Com

Sales Tax On Cars And Vehicles In Pennsylvania

Buying A Car In Pennsylvania If You Live In Ny Protect My Car

Car Tax By State Usa Manual Car Sales Tax Calculator

States With Highest And Lowest Sales Tax Rates

What Is The Pennsylvania Sales Tax On A Vehicle Purchase Etags Vehicle Registration Title Services Driven By Technology

How To Register A Car In Pennsylvania Metromile

What S The Car Sales Tax In Each State Find The Best Car Price

Form Mv 4st Vehicle Sales And Use Tax Return Application For Registration Templateroller